The Second UK Dash for Gas – A Faustian Bargain

The UK is set to embark on its second dash for gas. The first, beginning in the early 1990s, occurred when gas was first permitted to be used for power generation. Prior to that it had been considered a premium fuel too valuable to be used in this way. The regulatory change initiated a substantial building programme for combined cycle gas plants, fuelled by North Sea gas. Very quickly gas generation became a major component of baseload in the UK, despite warnings that North Sea gas was a temporary bonus and its depletion would leave a structural dependency on Russian gas.

Twenty years later, now that those warnings have been borne out, the UK is increasingly concerned about security of gas supply. The extent of the gas dependency has been greatly increased in the meantime by the housing bubble years, during which many very large, open plan homes were constructed, requiring gas for heating. Also, many more existing homes than previously have installed gas or electric central heating systems, and often these homes are poorly insulated.

As the years of cheap gas are over and gas prices rise inexorably, the structural dependency on cheap gas begins to cause real pain. Household energy bills are at record levels, having risen between 6-11% in 2012 and predicted to rise again in early 2013.

Fuel poverty is sharply increasing:

At the Fair Energy summit today, hosted by The Independent and Policy Review Intelligence, Ed Davey, the Energy Secretary, will remind energy companies about new rules which mean they will have to be more open about the reason why electricity and gas bills are increasing. He says companies are exaggerating the expense of the Government’s energy efficiency measures.

His comments will follow the shocking claim from the Government’s Fuel Poverty Advisory Group that 300,000 homes will be pushed into fuel poverty by Christmas. A household is considered to be in fuel poverty if it needs to spend more than 10 per cent of its income on fuel for adequate heating.

The group also warns that unless the Government tackles the problem of people being forced to choose between heating and eating, nine million households could fall into fuel poverty by 2016. It is estimated that six million households are already in fuel poverty.

The timing is particularly unfortunate, as the gas crunch is hitting at the same time as the credit bubble is bursting, falling house prices are leading to negative equity, austerity measures are being imposed, including welfare cuts for many of the poorest, unemployment is rising and household budgets are being considerably squeezed. The UK is also facing its third cold winter in a row. Estimates suggest that for every 1% increase in energy prices, about 40,000 households are pushed into fuel poverty.

In response, the British government has mandated The Energy Company Obligation to improve the energy efficiency of the housing stock, but there are concerns that these measures would initially add to energy bills:

The Energy Company Obligation (ECO), designed to cut bills of poor households by forcing suppliers to fit solid wall insulation, offer energy efficient boilers and other energy-saving measures, could add up to £116 to the average bill and push families that did not receive support further into fuel poverty. It said that while there were 2.7m fuel poor households in England alone, it expected the measure to help between 125,000 and 250,000 households out of fuel poverty by 2023.

Previous governments, going back at least twenty years, had been repeatedly advised to address the poor energy efficiency of the housing stock, particularly for public housing. They could have done this when mitigation would have been readily affordable, but chose to wait until the transition, if it can be afforded at all in a period of financial crisis, will be far more painful.

The current government has taken the fateful decision to pin its hopes, and much of the energy future of the country, on trying to prop up falling conventional gas supplies with unconventional alternatives. The second dash for gas has been launched with the lifting of the interim ban on fracking (imposed after minor seismic events in fracked areas) and plans to build 30 new gas plants. In his recent autumn statement, Chancellor George Osborne has announced the creation of a new Office for Unconventional Oil and Gas, along with plans for a system of generous tax incentives.

A wholesale commitment has been made to the ‘shale gas revolution’, with the promise of decades worth of affordable gas, and that the American experience of falling gas prices can be replicated in the UK. The Chancellor has indicated that he “does not want British families and business to be left behind as gas prices tumble on the other side of the Atlantic”. The hype has been considerable, despite the acknowledgement that, even if the gas is plentiful and the technology successful in extracting it, unconventional gas could not make a substantial contribution to current levels of gas demand for at least a decade. Britain will be in energy difficulties long before that.

Matt Ridley, former chairman of Northern Rock and author of Genome and The Rational Optimist, offered this hyperbolic, but ill-informed, endorsement:

As recently as 10 years ago, there was a consensus that gas was going to run out in a few decades and grow ever more expensive in the meantime. Such pessimism is now a distant memory everywhere, except perhaps in the forecasting models of the Department of Energy and Climate Change. Gas, the most abundant fossil fuel, is going to last at least a century, probably much longer.

London Mayor Boris Johnson is on the record with even more over-the-top pronouncements:

We are…increasingly and humiliatingly dependent on Vladimir Putin’s gas or on the atomic power of the French state. And then in the region of Blackpool – as if by a miracle – we may have found the solution. The extraction of shale gas by hydraulic fracture, or fracking, seems an answer to the nation’s prayers. There is loads of the stuff, apparently – about 1.3 trillion barrels; and if we could get it out we could power our toasters and dishwashers for the foreseeable future. By offering the hope of cheap electricity, fracking would make Britain once again competitive in sectors of industry – bauxite smelting springs to mind – where we have lost hope…

…In their mad denunciations of fracking, the Greens and the eco-warriors betray the mindset of people who cannot bear a piece of unadulterated good news. Beware this new technology, they wail. Do not tamper with the corsets of Gaia! Don’t probe her loamy undergarments with so much as a finger — or else the goddess of the earth will erupt with seismic revenge. Dig out this shale gas, they warn, and our water will be poisoned and our children will be stunted and our cattle will be victims of terrible intestinal explosions.

Clearly the mayor has no idea of the energy intensity of bauxite smelting, and no understanding of net energy, along with very little respect for the very real concerns surrounding shale gas. Still, he is really only propagating the exceptionally optimistic forecasts of Cuadrilla Resources, which has been doing the preliminary drilling in the Blackpool area:

The huge scale of a natural gas field discovered under the north-west of England has been revealed, potentially revolutionising the UK’s energy outlook and creating thousands of jobs, but environmental groups are alarmed at the controversial method by which the gas is extracted.

Preliminary wells drilled around Blackpool have uncovered 5.6tn cubic metres (200tn cubic ft) – equal to the kind of recoverable reserves of big energy exporting countries such as Venezuela, according to Cuadrilla Resources, a small energy company which has the former BP boss Lord Browne on its board. It said up to 800 more wells might be drilled in the region, creating 5,600 jobs and promising a repeat of the “shale gas revolution” that swept the US, sending local energy prices spinning downwards.

To compare shale gas in in Lancashire to Venezuela is simply laughable, especially on the basis of a handful of exploratory wells in one small region of the country, but then so is suggesting that the US will be the next Saudi Arabia based on shale energy resources. It seems the shale hype is rife on both sides of the Atlantic. Estimates such as 120 years UK supply, and a £1.5 trillion injection into the economy, are being enthusiastically bandied about, albeit with minor acknowledgement that not all of it may be recoverable.

Protesters demand blanket ban on fracking. Photo: PA

We have covered the shale energy situation in the US at TAE before in detail, both with regard to gas and to oil. To recap, the energy profit ratio is extremely low, meaning that scarcely any more energy is produced than had to be invested in production. Depletion rates are very high, setting producers on a drilling treadmill that runs ever faster. Fracking is both capital and energy intensive, requiring a substantial surplus of both, well in advance of needing a return on either one.

As we have pointed out before, prices are set by perception, not by reality. The perception of a gas glut is what has depressed gas prices in the US, not realistic long term prospects of producing gas in meaningful quantities. The reality is quite different, as the insiders know perfectly well:

Geologist and official from Anglo-European Energy:

After buying production for over 20 years, hopefully I know the characteristics of great wells (flat decline curves, low operating costs, large production), and as you know, the shale plays have none of these. The herd mentality into the shale will eventually end possibly like the sub-prime mortgage did. In the meantime it is very difficult to sell any kind of prospect that is not a shale play.

Analyst from PNC Wealth Management (2011):

Money is pouring in from investors even though shale gas is inherently unprofitable. Reminds you of dot-coms.

Analyst from IHS Drilling Data (2009):

The word in the world of independents is that the shale plays are just giant Ponzi schemes and the economics just do not work.

Retired geologist for major oil and gas company (2011):

As I think you would agree, we are looking at a bubble here with caveats. The caveats are how corporate hubris and bad science have caused a lot of folks to think that gas is nearly too cheap to meter. And now these corporate giants are having an Enron moment, they want to bend light to hide the truth. The bubble will burst, folks will get run over, reason will be restored, if only temporarily.

Official from Bold Minerals LLC (2010):

The ‘bait and switch’ where one massive set of capital outlays in the ‘best’ shale uncovered was soon to be eclipsed by the recognition of even better shales which required even more outlays before a thorough technical assessment of existing shale positions had been obtained could only be classified as a type of ‘mania’. It has no precedent in financial scale to any of the previous lease plays that experienced a speculative frenzy in domestic onshore petroleum history.

Official at Phoenix Canada Oil Company (2010):

It is my strong view that we will see a near collapse of that play, probably sooner rather than later. Perhaps we will see a repeat of the coal bed methane (CBM) play ‘disappearance’ — where that ‘exciting’ development faded into history ‘without a trace’!

Official from Schlumberger (2010):

All about making money. I’m working on a shale gas well that was just drilled in Europe. Looks like crap, but the operator will flip it based on ‘potential’ and make some money on it. Always a greater sucker….

The low gas prices seen in the US have been a financial disaster for the production companies, although in a classic ponzi move they have made money flipping land leases even as they lost it on producing gas at a higher cost than they could sell it for. Drilling rigs are already deserting shale gas plays in the US in favour of shale oil – the next great white hope (which happens to suffer from all the same deficiencies as shale gas).

Rig count is a leading indicator of production, so we can expect shale gas production in the US to fall substantially. As production falls, we could see the US shift from perceived glut into real shortage, given the dependence there on affordable gas for both heating and electricity. We could then see a major price spike.

This is exactly the boom and bust dynamic the UK is proposing to set itself up for as North sea depletion rates pick up steam and desperation sets in. After all, it was a similar desperation over conventional gas prospects that drove the industry in the US into trying to develop unconventional supplies. However, the UK is unlikely to experience the full upward and downward swing seen in the US. It is far more likely the reserves will prove to have been overstated, and opposition to fracking in the UK countryside will be huge – far larger than the already substantial protests against on-shore windfarms.

Unlike the US, where landowners are paid royalties for the gas under their land, in the UK, mineral rights are the property of the government. The disparity between where costs and impacts would lie and where benefits would accrue increases the odds of opposition even further. The inevitable protests could delay the process well into the era of financial crisis, at which point it would not be realistically affordable.

The choice to pursue the shale option has been labelled a dangerous gamble:

Professor John Stevens, Senior Research Fellow in Energy, Environment and Resources at independent analysis organization Chatham House, opposes the government’s promotion of shale gas as a viable energy alternative.

“Osborne’s view of the future of energy is misleading and dangerous. It is misleading because it ignores the very real barriers to shale gas development in the U.K. and Europe more generally,” he said this week.

“The U.S. revolution was triggered by favorable factors such as geology, tax breaks and a vibrant service industry among many others. However, in Western Europe the geology is less favorable, notably with the shale containing a higher clay content making it more difficult to use hydraulic fracturing (fracking),” he said. He called the U.K’s “dash for shale gas” a”dangerous gamble.”

Stevens added that the government’s hope that shale would reduce the rising costs of energy in the U.K. were flawed.

“[The government’s view] assumes that gas will be cheaper in the future and, as already explained, while this could be the case it will certainly not be the result of any shale gas revolution in U.K. or Europe in the next five to ten years.”

As Professor Stevens points out, circumstances in the US and the UK are not at all similar. The UK is far more densely populated, and land-use in the countryside is tightly controlled. Fracking requires space and infrastructure:

Melissa Stark, Managing Director of Accenture’s Clean energy group, said shale gas can require a number of wells over one site. Even if the number of wells can be reduced by horizontal drilling, the site will need roads, machinery and storage facilities.

“One of the biggest challenges for the UK is probably going to be the population density. The UK is much more densely populated than the US making the management of movements more challenging.

“The sharp influx of logistics activity during the drilling and fracking phases can have a significant impact on the local community. Increased traffic congestion, damage to local roads, noise and air pollution are among the most commonly cited concerns.”

Ms Stark pointed out that fracking is extremely water intensive, requiring around 5m gallons per well. Although the UK is not a water stressed area, she pointed out that in certain areas in certain years, industrial water use can be restricted. Also the waste water from fracking needs to be transported off the site and treated or injected into wells deep underground. She said the UK will have to find disposal sites or build enough treatment works.

“As the volume grows, the question is can the used water treatment works keep up?”

In anticipation of substantial opposition, the government is preparing to remove planning control for fracking from local municipalities:

Under new laws, Government ministers, rather than local authorities, could have the final say on more “nationally significant infrastructure” projects, including onshore gas extraction. Proposals in the Growth and Infrastructure Bill would would exempt shale gas plans from some local planning procedures and consultations. The laws are aimed at stopping local blockages in the planning system to fast-track infrastructure and boost economic growth. Campaigners, who warn that fracking could cause “major damage” to the landscape, could have less opportunity to challenge unwanted developments.

Vague promises of ‘community benefits’, particularly if these come in the form of “voluntary contributions by developers to an area where their business has a long–term impact on local resources and the environment” are unlikely to appease anyone. However, if proposals to share business rates with local councils are, in fact, enacted, then councils, which a very squeezed financially, and set to become far more so, could effectively be bought off.

Apparently over 60% of England is currently under ‘license block’ consideration for the development of shale gas, much of it under the Home Counties. It is ironic that Conservative Party politicians are the most ardent champions of shale gas development, yet the land that would be affected is home to much of their key powerbase.

This does seem to be an obvious form of political suicide, and the fact that the present government seems blind to that is a measure of the level of concern over Britain’s energy future. The powerful impulse to deny reality in order to cling to business as usual is understandable, but terribly misguided.

Under such circumstances, it is natural human behaviour to look for a saviour. Given our ghastly choices, it wouldn’t be surprising if we were susceptible to false dawns….With the West on its economic uppers, and losing power relative to the rest of the world, a home-grown energy bonanza sounds appealing…

When the big energy companies and Western governments push in the same direction, they can, for a while anyway, create any conventional wisdom they like, even one with little regard for the facts.

Unfortunately for proponents of the appealing fantasy, reality wins in the end. We are not destined to see the geo-strategic map redrawn in favour of the West as a result of shale energy. Instead, we are going to be facing some very hard decisions on rationing scarce resources for the foreseeable future, and we are going to be doing it in a time of deepening financial crisis. Britain will be critically short of both money and energy, and sadly those twin deficits can be expected to aggravate each other significantly.

Shale gas is a Faustian bargain meant to kick the energy can down the road, but it amounts to nothing more than a cruel deception.

Shale Gas Reality Begins to Dawn

It has long been our position at The Automatic Earth that North America is collectively dreaming with regard to unconventional natural gas. While gas is undeniably there, the Energy Returned On Energy Invested (EROEI) is dramatically lower than for conventional supplies. The critical nature of EROEI has been widely ignored, but will ultimately determine what is and is not an energy source, and shale gas is going to fail the test.

As we pointed out in Get Ready for the North American Gas Shock in July 2011, the natural gas situation is not what it seems at all:

The shale gas bubble is a perfect example of the irrationality of markets, the power of perverse short-term incentives, the driving force of momentum-chasing, the dominance of perception over reality in determining prices, and the determination for a herd to stampede over a cliff all at once.

The perception of a gas glut has driven prices so low that none of the participants are making money (at least not by producing gas) or creating value. We see a familiar story of excessive debt, and the hollowing out of productive companies dead set on pursuing a mirage.

Many industry insiders know perfectly well that the prospects for recovering substantial amounts of gas are poor, and that the industry is structured as a ponzi scheme. Still, there has been money to be made in the short term by flipping land leases and building infrastructure to handle gas.

The hype is so extreme that those who fall for it contemplate, in all seriousness, North America becoming a natural gas exporting powerhouse, and a threat to Australian LNG producers, or to Russia’s Gazprom.

This concept, constructed from a mixture of greed and desperation (at the lack of conventional gas prospects), is entirely divorced from reality. (See here for Dimitri Orlov’s excellent piece on why Gazprom has nothing to worry about.)

Nevertheless, euphoric hype is extremely catching. Given that prices are driven by perception, not by reality, hype has the power to change the dynamics of an industry, exaggerating boom and bust cycles in practice. The hype has resulted in the perception of glut – that North America is drowning in natural gas. The inconvenient fact that this perception is completely wrong does not alter its power in relation to prices.

Natural gas companies gambling on shale gas have been facing prices so low – far below the cost of production – that all of them have been producing gas unprofitably. The financial risk has been increasing dramatically as the companies have been drowning in debt trying to ride out the rock bottom prices that have been the result of people believing the fantasy. Finally, casualties of the financial shenanigans involved are emerging. It is very likely that there will be many more, as companies that have tried to ride out the low prices go under.

Wolf Richter:

Natural Gas: Where Endless Money Went To Die

Alas, thanks to the Feds zero-interest-rate policy and the trillions it has handed over to its cronies since late 2008, the sweeps of creative destruction have broken down. Instead, boundless sums of money have been searching for a place to go, and they’re chasing yield when there is none, and so they’re taking risks, any kind of risks, in their vain battle to come out ahead.

The result is a stunning misallocation of capital to the tune of tens of billions of dollars to an economic activity drilling for dry natural gas that has been highly unprofitable for years. It’s where money has gone to die. What’s left is debt, and wells that will never produce enough to make their investors whole.

But the money has dried up. And drilling for natural gas is collapsing. Last week, there were only 562 rigs drilling for dry natural gas, the lowest number since September 1999…

…At $2.53 per million Btu at the Henry Hub, the price of natural gas is up 33% from the April low of $1.90 per million Btu, a number not seen in a decade.

.But even if it doubled, it would still be below the cost of production. And if it tripled, it might still be below the cost of production for most producers. That’s how mis-priced the commodity has become.

More from Wolf Richter:

Dirt Cheap Natural Gas Is Tearing Up The Very Industry That’s Producing It

The economics of fracking are horrid. All wells have decline rates where production drops over time. But instead of decades for traditional wells, decline rates in horizontal fracking are measured in weeks and months: production falls off a cliff from day one and continues for a year or so until it levels out at about 10% of initial production. To be in the black over its life under these circumstances, a well in the Barnett Shale would have to sell its production for about $8 per million Btu, pricing models have shown.

…Drilling is destroying capital at an astonishing rate, and drillers are left with a mountain of debt just when decline rates are starting to wreak their havoc. To keep the decline rates from mucking up income statements, companies had to drill more and more, with new wells making up for the declining production of old wells. Alas, the scheme hit a wall, namely reality…

…The natural gas business is brutal. The peak in drilling occurred in September 2008 with 1,606 rigs. Then the financial crisis threw it into a vertigo-inducing plunge. After last years mini-peak, the plunge continued…

…Production lags behind rig count, and while rig count for gas wells has been setting new decade lows, production has been rising month after month to new record highs. But lagging doesn’t mean decoupled. And someday…. Oops, it already happened. It has started. Production has turned the corner, and not just in one field, but across the US.

Its still just a little notch in the curve. But its a sign that the collapse in rig count is translating into lower production numbers. And when the steep decline rates are beginning to overlap the drop in rig count, production will head south in a dizzying trajectory.

Money has been thrown at the industry, but the notion is dawning that the game is up and that returns will never materialise. The ponzi scheme has reached its natural limit, and investors are waking up to the realisation that they have been chasing a fantasy.

Ironically, just as the washout begins, natural gas prices may have bottomed. Conventional natural gas in North America peaked in 2001. Coal bed methane and now shale gas have been revealed to be massively overblown as an energy source. Producers are reaping the consequences of mal-investment and will be going out of business. Demand has been building with the transition from coal to natural gas for power generation. This is an ideal set up for a supply collapse and subsequent price spike.

North America is poised for a huge natural gas shock. Far from being an exporter, North America is going to experience a natural gas supply crunch. Prices will be rising at the same time as peoples purchasing power falls precipitously, thanks to deflation. The structural dependency on natural gas that has been cemented in recent years is going to guarantee maximum pain as prices reconnect with reality.

Fracking Our Future

Last week, in Get Ready for the North American Gas Shock, The Automatic Earth evaluated the prospects of shale gas, a supposedly plentiful and clean fuel upon which many have placed their hopes of both energy supply and handsome profits. The first part of our shale gas analysis concentrated on supply and EROEI (energy returned on energy invested), pointing out that reserves are very much overstated and that the sector is in fact in a major bubble. In this follow up, we are going to assess the other major claim – that shale gas is a clean energy source, and would constitute an improvement in environmental terms over reliance on oil and coal.

Fracking: The Great Shale Gas Rush

Along with wind, solar, and nuclear power, natural gas is crucial to Obama’s goal of producing 80 percent of electricity from clean energy sources by 2035. But the drilling is taking place with minimal oversight from the U.S. Environmental Protection Agency. State and regional authorities are trying to write their own rules—and having trouble keeping up.

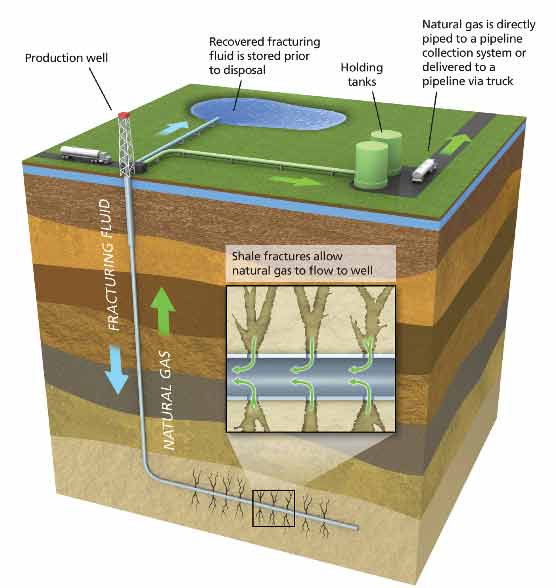

Shale gas is contained in impermeable reservoir formations deep beneath the surface. In order to release the gas for extraction, the rock must be hydraulically fractured (fracked). Pipes are inserted by drilling first vertically into the formation, then horizontally along it in many different directions from a common well pad. The pipes are constructed like a soaker hose, with holes along their length. A mixture of water (99%), sand and a proprietary mixture of chemicals is injected thousands of feet down under very high pressure, multiple times per well.

The water – 2 to 6 million gallons per well – (a challenge in arid regions) fractures the formation rock where it exits through the holes in the pipe. The sand acts as a propping agent, entering the fractures and keeping conduits open while providing for permeability to gas flow. The released gas then flows into and up the pipe to be collected at the surface. The long horizontal pipes allow for a large surface area in contact with gas-bearing rock, maximizing extraction.

Fracking was first implemented by Halliburton in 1949, but only became common much more recently in combination with horizontal drilling, and once the companies had been exempted from important environmental legislation.

It really wasn’t until 2004 that fracking really took off, the year that the EPA declared that fracking “posed little or no threat” to drinking water. Weston Wilson, a scientist and 30-year veteran of the agency, who sought whistleblower protection, emphatically disagreed, saying that the agency’s official conclusions were “unsupportable” and that five of seven members of the review panel that made the decision had conflicts of interest. (Wilson has continued to work at the EPA, and continues to be publicly critical of fracking.)

A year later, Congress passed the Energy Policy Act with a “Halliburton loophole,” a clause inserted at the request of Dick Cheney, who had been Halliburton’s CEO before becoming vice president. The loophole specifically exempts fracking from the Safe Drinking Water Act, the Clean Water Act, the CLEAR Act, and from regulation by the Environmental Protection Agency, and it unleashed the largest and most extensive drilling program in history, according to Josh Fox, the creator of the film Gasland.

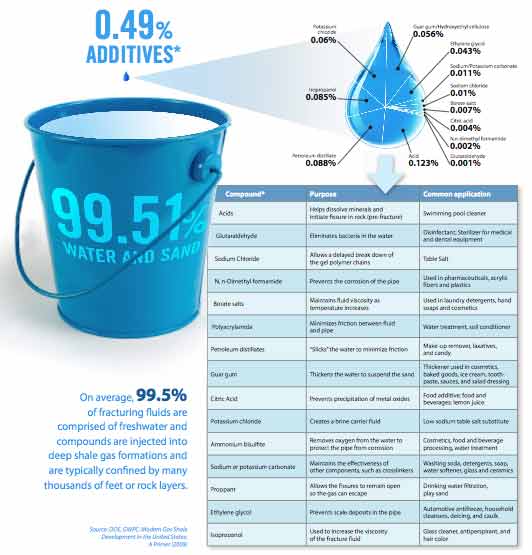

The chemicals added serve a number of purposes, including preventing the growth of slime organisms, keeping the sand in suspension, preventing scale build-up and reducing friction. Fracking fluids typically contain biocides, surfactants, and corrosion and scale inhibitors, among other ingredients. The exact composition of the fluid is not made public, although it may be revealed to local regulators. Many of the chemicals used are toxic or carcinogenic, and their use is highly contentious.

Although added chemicals comprise less than 1% of the fracking fluid, that still amounts to a small percentage of a very large number. Given the enormous quantities of fluid involved. and the toxicity of the additives, concern is justified.

By examining drillers’ patent applications and government worker health and safety records, some environmentalists and regulators in the US have been able to piece together a list of some of the fracking fluid ingredients. These include potentially toxic substances such as diesel fuel (which contains benzene, ethylbenzene, toluene, xylene, and napththalene), 2-butoxyethanol, polycyclic aromatic hydrocarbons, methanol, formaldehyde, ethylene, glycol, glycol ethers, hydrocholoric acid, and sodium hydroxide.

Half or more of the fracking fluid, along with water from the rock formation (which can contain heavy metals and other minerals), typically returns to the surface for disposal, where it is stored in ponds. These ponds can unfortunately leak, and evaporation of volatile chemicals can cause local air pollution. Disposal is expensive, both in financial and energy terms. The need for energy-intensive disposal lowers the Energy Returned on Energy Invested (EROEI) for the shale gas extraction life cycle.

A number of states allow fracking fluid to be disposed of to land, but this can have significant consequences.

A study that argues for more research into the safe disposal of chemical-laced wastewater resulting from natural gas drilling found that a patch of national forest in West Virginia suffered quick and serious loss of vegetation after it was sprayed with hydraulic fracturing fluids. The study, by researchers from the United States Forest Service, was published this month in the Journal of Environmental Quality. It said that two years after liquids were legally spread on a section of the Fernow Experimental Forest, within the Monongahela National Forest, more than half of the trees in the affected area were dead. [..] Almost immediately after disposal, the researchers said, nearly all ground plants died. After a few days, tree leaves turned brown, wilted and dropped; 56 percent of about 150 trees eventually died.

The gas industry claims that there are no health or environmental effects from the fracking process, but these claims are hotly disputed. A primary concern is the potential for aquifer contamination, which can have significant adverse impacts on people’s well water. In rural areas, there may be a very large number of drinking water wells. While the fracked formations are generally many thousands of feet below aquifers, poorly constructed well casings can leak. Also, natural faults within the rock strata could allow fracking fluids or methane or both to migrate upwards.

Shale gas wells can be very densely packed, and in many places well drilling and fracking activity have increased by an order of magnitude or more in a few short years thanks to the frenetic activity brought about by the shale gas bubble.

Jessica Ernst says she’s “still getting used to” being compared to Erin Brockovich (the environmental activist made famous by Julia Roberts’ film portrayal ten years ago). The comparison comes easy because the outspoken Ernst, a landowner in the town of Rosebud, Alberta, is one of the few Albertans who have publicly criticized hydraulic fracturing [..]

After her well water was contaminated by nearby fracking in 2006, Ernst decided to go public, showing visiting reporters how she could light her tap water on fire, and speaking out about Alberta land owners’ problems with the industry, especially Calgary-based EnCana. EnCana is Canada’s second biggest energy company (after Suncor) and is now also a major player in British Columbia, with hundreds of natural-gas wells in the province.

Ernst, a biologist and environmental consultant to the oil and gas industry, says EnCana “told us ‘we would never fracture near your water.’ But the company fracked into our aquifer in that same year [2004].” By 2005, she says, “My water began dramatically changing, going bad. I was getting horrible burns and rashes from taking a shower, and then my dogs refused to drink the water. That’s when I began to pay attention.” More than fifteen water-wells had gone bad in the little community. Tests revealed high levels of ethane, methane, and benzene in Ernst’s water.

Dimock, Pennsylvania, is another region where significant impacts have undoubtedly manifested. Consider the experience of the Sautner family and their neighbours:

Drilling operations near their property commenced in August 2008…..Within a month, their water had turned brown. It was so corrosive that it scarred dishes in their dishwasher and stained their laundry. They complained to Cabot[Houston-based Cabot Oil & Gas, a midsize player in the energy-exploration industry], which eventually installed a water-filtration system in the basement of their home. It seemed to solve the problem, but when the Pennsylvania Department of Environmental Protection came to do further tests, it found that the Sautners’ water still contained high levels of methane. More ad hoc pumps and filtration systems were installed. While the Sautners did not drink the water at this point, they continued to use it for other purposes for a full year.

“It was so bad sometimes that my daughter would be in the shower in the morning, and she’d have to get out of the shower and lay on the floor” because of the dizzying effect the chemicals in the water had on her, recalls Craig Sautner, who has worked as a cable splicer for Frontier Communications his whole life. She didn’t speak up about it for a while, because she wondered whether she was imagining the problem. But she wasn’t the only one in the family suffering. “My son had sores up and down his legs from the water,” Craig says. Craig and Julie also experienced frequent headaches and dizziness.

By October 2009, the Department of Environmental Protection had taken all the water wells in the Sautners’ neighborhood offline. It acknowledged that a major contamination of the aquifer had occurred. In addition to methane, dangerously high levels of iron and aluminum were found in the Sautners’ water. The Sautners now rely on water delivered to them every week by Cabot. The value of their land has been decimated….They desperately want to move but cannot afford to buy a new house on top of their current mortgage.

Frenetic activity is not the best circumstance for ensuring care and attention to detail, even when the price of carelessness can be effectively permanent groundwater contamination with highly toxic or explosive substances. Accidents can happen. For instance a well in Clearfield County, Pennsylvania, experienced a blow-out on June 3rd 2010 that was determined to have been easily preventable. Had the released gas ignited, the consequences could have been dire. As it was, gas, along with 35,000 gallons of drilling fluid, spewed from the well for 16 hours before the situation was brought under control.

DEP Secretary John Hanger announced that an independent investigation confirmed that the incident was preventable and EOG Resources ignored industry standards by failing to install proper barriers in the well and hiring uncertified operators. Hanger also said that EOG Resources failed to alert emergency authorities until several hours after the blowout, which hindered the state’s response.

“Make no mistake, this could have been a catastrophic incident,” Hanger said. “Had the gas blowing out of this well ignited, the human cost would have been tragic, and had an explosion allowed this well to discharge wastewater for days or weeks, the environmental damage would have been significant.” John Vittitow, an experienced petroleum engineer hired by the DEP to conduct the investigation, made an eerie comparison to the Deepwater Horizon disaster in the gulf as he described the failed blowout preventer that led to the incident. Vittitow said that EOG Resources only installed one pressure barrier during a well clean-out procedure, while industry standards call for at least two barriers in case of failure.

Hanger admitted that state regulations on well operations are broad and regulators would have to be “more prescriptive” to ensure that well operators use at least two barriers in the future. Vittitow’s investigation also revealed that the C. C. Forbes operators lacked industry certifications that are mandatory in most companies.

It is no surprise that regulators are struggling to keep pace with events and little authoritative research has been done on environmental effects. Received wisdom has become that shale gas is both clean and plentiful, and it can be very difficult to get funding to challenge received wisdom and powerful vested interests in any field. A team from Duke University recently undertook research on well water impact in New York and Pennsylvania, sampling 68 private wells at varying distances from from drilling activity.

The trends were immediately clear: those within 1km of an active drilling site were much more likely to have high levels of methane, on average 17 times higher than those sites more distant from active drilling. That average covers a broad range, too. Some sites were indistinguishable from the typical inactive well, while others had concentrations of methane between 19.2 and 64 mg/l, enough to pose an explosive hazard, and high enough to qualify for hazard mitigation under the Department of the Interior’s rules.

The Duke team has been criticized by the shale gas industry for lacking baseline data, yet the industrial players themselves have the necessary data and refuse to release it.

Ever since high-profile water contamination cases were linked to drilling in Dimock, Pa., in late 2008, drilling companies themselves have been diligently collecting water samples from private wells before they drill, according to several industry consultants who have been working with the data. While Pennsylvania regulations now suggest pre-testing water wells within 1,000 feet of a planned gas well, companies including Chesapeake Energy, Shell and Atlas have been compiling samples from a much larger radius—up to 4,000 feet from every well. The result is one of the largest collections of pre-drilling water samples in the country.

“The industry is sitting on hundreds of thousands of pre and post drilling data sets,” said Robert Jackson, one of the Duke scientists who authored the study, published May 9 in the Proceedings of the National Academy of Sciences….”I asked them for the data and they wouldn’t share it.”

Air pollution can also be a major issue in fracking centres, some of which are densely populated.

The picture from Dish is not pretty. A set of seven samples collected throughout the town analyzed for a variety of air pollutants last August found that benzene was present at levels as much as 55 times higher than allowed by the Texas Commission on Environmental Quality (TCEQ). Similarly, xylene and carbon disulfide (neurotoxicants), along with naphthalene (a blood poison) and pyridines (potential carcinogens) all exceeded legal limits, as much as 384 times levels deemed safe. “They’re trying to get the pipelines in the ground so fast that they’re not doing them properly,” says Calvin Tillman, Dish’s mayor. “Then you’ve got nobody looking, so nobody knows if it’s going in the ground properly…. You just have an opportunity for disaster here.”

Dish sits at the heart of a pipeline network now tuned to exploit a gas drilling boom in the Fort Worth region. The Barnett Shale, a geologic formation more than two kilometers deep and more than 13,000 square kilometers in extent, holds as much as 735 billion cubic meters of natural gas—and the city of Fort Worth alone boasts hundreds of wells, according to Ed Ireland, executive director of the Barnett Shale Energy Education Council, an industry group. “It’s urban drilling, so you literally have drilling rigs that are located next door to subdivisions or shopping malls.”

Air pollution from fracking in agricultural areas can also have significant negative impacts.

According to Jaffe, ozone is more lethal to crops than all other airborne pollutants combined, and of all crops, few are more susceptible to it than clover, a nutrient-rich feed that is critical to his method of sustainable cattle raising. While ozone is normally associated with automobile exhaust, fracking generates so much of it that Sublette Country, Wyo., has ozone levels as high as Los Angeles. This, despite the fact that it has fewer than 9,000 residents spread out over an area the size of Connecticut. What it does have is gas wells.

Besides the effect of ground-level ozone on animal feed, there can be other more direct impacts on livestock and on farmers’ ability to make a living.

Last year, the Pennsylvania Department of Agriculture quarantined 28 cattle belonging to Don and Carol Johnson….The animals had come into wastewater that leaked from a nearby well that showed concentrations of chlorine, barium, magnesium, potassium, and radioactive strontium. In Louisiana, 16 cows that drank fluid from a fracked well began bellowing, foaming and bleeding at the mouth, then dropped dead.

Livestock farmers are concerned that the mere presence of wells in the area could lead to suppliers ceasing to purchase their animals, for fear of contamination, whether or not animals do in fact come into contact with noxious chemicals in the air or water. They are also concerned about the lack of regulation and oversight of the industry as it may impact of their livelihoods.

For the most part, state and federal governments have turned a blind eye to the problems brought about by fracking. The Environmental Protection Agency (EPA) claims that it has no jurisdiction to investigate matters related to food production, a contention disputed by Congressman Maurice Hinchey (D-NY), who wrote a report urging the EPA to study all issues associated with fracking. A concerned farmer who prefers not to be identified forwarded me an email written to him by Jim Riviere, the director of the Food Animal Residue Avoidance Databank, a group of animal science professors that tracks incidents of chemical contamination in livestock.

Riviere wrote that his group receives up to 10 requests per day from veterinarians dealing with exposures to contaminants, including the byproducts of fracking. Nonetheless, the United States Department of Agriculture (USDA) has slashed funding to his group. “We are told by the newly reorganized USDA that chemical contamination is not their priority,” Riviere wrote.

Land owners are concerned about the value of their property, since some banks will not grant mortgages on real estate in fracked areas. As is often the case perception, particularly fear of risk, matters a great deal. Of course on the other side of the financial equation, a lot of revenue is dependent on the shale gas business. There are both winners and losers. For instance, in some states huge amounts of state pension funds are invested in shale gas companies.

In Pennsylvania, where 2,516 wells have been drilled in the last three years, $389 million in tax revenue and 44,000 jobs came from gas drilling in 2009, according to a Penn State report.

A number of jurisdictions either have banned fracking or are considering doing so. Quebec decided in March 2011 to wait for a detailed environmental study of the process, despite the putative value of the gas contained in the Utica shale formation and the private capital committed to the industry. Acceptance of the practice there, where there is no history of oil and gas exploration, is the lowest in Canada at 22% (compared to 46% in Alberta where the oil and gas industry is well established).

It has been a swift fall from grace for junior exploration companies whose fortunes are tied to Quebec’s nascent shale gas industry. Calgary-based Questerre Energy Corp., worth $800-million only a year ago, has a market capitalization barely one fourth of that today as investors cashed out following the Quebec government’s decision in March to put commercial hydraulic fracturing drilling on hold pending a detailed environmental review. Junex Inc. and Gastem Inc. aren’t faring any better. Each has seen its stock fall more than 50% off their 52-week highs on the Toronto Venture Exchange [..]

For Questerre, Quebec’s decision forced a brutal reckoning. The company holds development rights to more than one million gross acres of farmland along the southern flank of the St. Lawrence River in Quebec, smack in the middle of what has become known as the Utica shale gas formation. It estimates its property could yield a prospective recoverable resource of 18 trillion cubic feet. Its entire business plan was focused on developing Quebec gas [..]

Quebec has now decided it will not approve shale gas development until it’s proven safe by independent study. A panel of 11 experts has been mandated to undertake a strategic environmental assessment expected to take between two and three years. In the meantime, the province has cancelled exploration permits without compensation and issued a new set of regulations to govern shale gas development. Detailed administrative practices should follow.

Others jurisdictions are contemplating lifting bans already imposed, as the supposed benefits may seem simply too enticing. New York state, underlain by the Marcellus Shale, is suggesting a compromise, by allowing fracking in some locations, while attempting to protect watersheds and other sensitive locations. The decision is not popular.

Gov. David A. Paterson vetoed a bill passed by the Legislature last year that would have formally banned hydrofracking, but effectively put a ban into place until further study was completed. The Cuomo administration is seeking to lift what has effectively been a moratorium in New York State on hydraulic fracturing [..]

The process would be allowed on private lands, opening New York to one of the fastest-growing — critics would say reckless — areas of the energy industry. It would be banned inside New York City’s sprawling upstate watershed, as well as inside a watershed used by Syracuse, and in underground water sources used by other cities and towns. It would also be banned on state lands, like parks and wildlife preserves. It will most likely take months before the policy becomes official [..]

“This report strikes the right balance between protecting our environment, watersheds and drinking water, and promoting economic development,” said Joseph Martens, the commissioner of the department, a state agency controlled by the governor’s office.

It is not difficult to imagine the cause for opposition, since the Marcellus Shale lies beneath the largest unfiltered drinking water supply system in the USA, which provides over a billion gallons of water per day to New York City. Industry insider James Northrup, recently relocated from Texas to New York State, explains a number of the difficulties associated with the Macellus Shale in particular.

In summary, Mr Northrup points out that the rock formation of the Marcellus is particularly tight. The pressure required to frack the formation horizontally can be up to 15,000 psi (equivalent to the pressure 6 miles beneath the ocean being applied to several million gallons of water), which is much higher than was necessary for the older vertical wells in the Barnett Shale where the existing regulations were developed. This is like exploding a substantial pipe bomb underground in a geologically complex area where there is poor seismic data.

In other words, no one knows where the many faults are, and no one can dismiss the risk that racking fluid will end up in an aquifer. Oil based fluids, being lighter than water, will rise to the top of contaminated aquifers, ending up disproportionately in well water. Mr Northrup explains that the industry need not use toxic chemicals, and indeed should not, especially where the risk of groundwater contamination appears to be uncomfortably high. Even without toxic chemicals, Mr Northrup argues that fracking should not happen where seismic data is inadequate, as gas migration can still represent an explosion hazard.

Geologist Arthur Berman also has major concerns regarding the Marcellus Shale. He feels that the risk of capital destruction is unusually high, thanks to the large extent of the play which will make it more difficult to identify the core areas, or sweet spots, that shale gas plays always contract to. Existing gas pipeline infrastructure is inadequate and will require time to build out, but gas wells are being drilled now.

Valuable natural gas liquids, which must be removed prior injecting the gas into a pipeline, will be difficult to separate given the insufficient fractionation plant capacity. Obtaining permission for the very high volume water withdrawals required is likely to be problematic, as is transporting waste water to the few waste treatment plants in the region.

In addition, high population density in the area of the play will make it far more difficult to assemble acreage blocks, and will heighten the potential impact of any accidents. The objections may be legion, as the large population at risk expresses its intolerance of that risk.

Given the poor economics and low EROEI of shale gas in general. It is very difficult to argue that fracking, particularly in areas like the Marcellus Shale, makes sense. Unconventional gas is far from being a clean fuel when the whole lifecycle is considered. In fact considering the substantial potential for releases of fugitive methane emissions, one cannot even argue that unconventional gas is an improvement in comparison with burning coal when it comes to climate impact, let alone an improvement on other environmental fronts.

Shale gas is simply another Faustian bargain that humanity should not be making. We run substantial long term risks, which we socialize, for the sake of short term private profits.

This is the typical human modus operandi, but it is high time we learned from our mistakes.