Adaptive cycles are the foundation of both natural ecological and human socio-economic systems, and have been investigated independently from very different perspectives by ecologists and financial analysts who have almost certainly never heard of each others’ work. It is interesting then to look at the strong correspondence of the self-similar hierarchical patterns, best described as fractals, which emerge from both fields. This form of organization seems to be a fundamental dynamic in many areas.

The bewildering, entrancing, unpredictable nature of nature and people, the richness, diversity and changeability of life come from that evolutionary dance generated by cycles of growth, collapse, reorganization, renewal and re-establishment. We call that the adaptive cycle.

Holling, 2009

Holling, Panarchy and Resilience

Arguably the most significant thinker in the field of ecological cycles has been Buzz Holling, who refers to the conceptual model he derived from the study of forest ecosystems as Panarchy. Holling observed that ecosystems developed in adaptive cycles of exploitation, conservation, release and reorganization which could be described in three dimensions – ecological ‘wealth’, connectedness and resilience. These cycles provide a framework for the opposing forces of growth and stability versus change and variety.

In an adaptive cycle, early growth is rapid as individuals of many species arrive in a newly opened space and seek to exploit a plethora of vacant ecological niches. Genetic diversity and biomass, both living and dead, increase quickly in this expansion phase. Ecological connections are initially simple and sparse, but over time many interconnections and mutual dependencies develop.

The system therefore increases in both ‘wealth’ and connectedness, as flows of energy and materials become larger and more complex. Biological ‘wealth’ confers the potential for novelty, allowing the system to adapt in disparate directions as circumstances warrant. Connectedness permits increasing stability, through the development of negative feedback loops, which help to regulate conditions conducive to life.

There are about three kinds of scientists – the consolidator, the technical expert, and the artist. Consolidators accumulate and solidify advances and are deeply skeptical of ill formed and initial, hesitant steps. That can have a great value at stages in a scientific cycle when rigorous efforts to establish the strength and value of an idea is central. Technical experts assess the methods of investigation. Both assume they search for the certainty of understanding.

Holling, 2009

In contrast, I love the initial hesitant steps of the “artist scientist” and like to see clusters of them. That is the kind of thing needed at the beginning of a cycle of scientific enquiry or even just before that. Such nascent, partially stumbling ideas, are the largely hidden source for the engine that eventually generates change in science. I love the nascent ideas, the sudden explosion of a new idea, the connections of the new idea with others. I love the development and testing of the idea till it gets to the point it is convincing, or is rejected. That needs persistence to the level of stubbornness and I eagerly invest in that persistence.

As time passes, rapid growth gives way to conservation. Inter-dependencies become highly specialized and self-regulation becomes fine-tuned and sophisticated. Efficiency is maximized as niches are fully occupied, and flows of energy and nutrients are tightly controlled by the existing biota. This represents the end of the growth phase.

Relatively few opportunities are left for newcomers or novel strategies, hence diversity stabilizes or declines. The system is ‘rich’, but becomes more rigid, and therefore less resilient in the face of potential shocks, which can propagate rapidly through a highly inter-connected system with smaller margins for error than it had in its generalist phase. An increasingly brittle ecosystem becomes, in Holling’s words, “an accident waiting to happen”.

When something does push the ecosystem outside of the boundaries it can tolerate, the long growth phase can morph into a rapid and chaotic release and reorganization phase, where nutrients and energy stores previously tied up can suddenly be liberated. This can be associated with a considerable loss of complexity, but also with much greater potential for generalist strategies and for novelty.

During the growth phase the system finds an abundance of resources available. Expansion and exploration of new opportunities are key concepts within this stage. “When new ecological spaces open up – due, for instance, to forest fires, or retreating glaciers, or many other things- resources needed for other species to grow are made available. There’s more light reaching the soil surface when large trees are toppled, or burned to the ground, for example.”

“The “r” phase is transitory, and as the system matures, it is replaced by the K phase. Eventually slower growing, long lived species or entities enter the system. Resources become less widely available as they become “locked up”… The K phase is sometimes called the conservation phase, because energy acquired goes into maintaining or conserving existing structure, rather than building new structure. In this phase, a few dominant species or companies or countries … have acquired many of the resources and are controlling the way they can be used.”

“Often systems rapidly pass into a phase called omega. This is also referred to as the release (or creative destruction) phase because structure, relationships, capital or complexity accumulated during the r and K phases is released (often in a dramatic or abrupt fashion). … Plants may die … or a company may go bankrupt, releasing workers and decommissioning factories or offices.”

“The fourth, or alpha phase, is a period of reorganization, in which some of the entities previously released begin to re-structure but not necessarily as they were before. This phase can mark the beginning of another trip through an adaptive cycle … Many new entities may enter the system, and innovation becomes more probable.”

Project Shrink

However, such adaptive cycles do not exist in isolation. Local ecosystem cycles are embedded in larger and slower-moving regional cycles operating over years and decades, which are in turn part of global climate and elemental cycles (carbon, nitrogen, phosphorus etc) that may unfold over centuries or millennia. These larger cycles can act as stabilizing factors by adding a ‘memory effect’, or wealth reservoir, enabling rapid regeneration following a localized setback, but only if the larger cycle is not in its own contraction and reorganization phase. In addition to being part of larger cycles, dynamic ecosystems are also composed of smaller and faster-moving cycles of growth and decay, operating on much shorter time horizons. This nested set of self-similar structures allows for both persistence and innovation.

Where higher and lower order cycles are very tightly coupled, they may synchronize, becoming trapped in a extended growth phase at many scales at once, thereby risking synchronous collapse. This need not be triggered at a large-scale level, but can begin anywhere in a set of nested adaptive cycles and proceed both upwards and downwards. A destabilizing event arising from below, for instance a disease outbreak leading to widespread morbidity and further adverse consequences, is called a ‘revolt’.

A synchronous collapse, which can take the form of a “pancaking implosion”, to use Holling’s term, can lead to a poverty trap, or persistent maladaptive state characterized by low ‘wealth’ and connectivity, which is very much more difficult to recover from than a localized reversal would have been.

By way of illustration, the Canadian province of British Columbia is currently facing a confluence of circumstances that pose a significant large-scale ecological threat. A long-standing policy of fire-suppression, in a hitherto naturally fire-controlled ecosystem, has led to a thick understory of growth, which has in turn caused significant stress to trees forced to compete for water and nutrients in an area becoming warmer and drier. Trees under stress have much lower resistance to pine beetle infestation, with the result that a pine beetle population explosion is killing huge tracts of forest despite all efforts to contain the outbreak.

This adds to the combustible material on the forest floor and greatly increases the risk of widespread conflagration. The much smaller self-limiting fires typical of the province would have opened up areas for new growth, killed insect pests and released nutrients for regeneration, and in fact are required by some tree species in order to open up seed pods for reproduction. In contrast, very large and intense fires, fueled by a tremendous excess of flammable detritus, can comprehensively denude enormous tracts of land.

This can remove the biological reservoir of potential repopulating species as well as lead to enough soil erosion to inhibit regrowth of the forest ecosystem. An interlocking series of adaptive cycles has been synchronized through being locked into an extended growth phase and is therefore much more vulnerable to a catastrophic event that could become a lasting poverty trap.

When collapse occurs it can be a natural part of the pattern of adaptation and learning. That is what happens in forests when they burn or are attacked by natural enemies. Recovery typically replaces the old with a similar but new pattern that is similar because of the memory reserved in seeds and vegetation of the understory.

Holling, 2009

But when the collapse occurs as a consequence of long effort to freeze the system into one paradigm of development and management, then it might involve collapse of a level of the panarchy, which in turn threatens other levels. The collapse of ancient societies has this character- the top religious and political controls can collapse, triggering the gradual collapse of institutions till the family is left as the sole source of survival. It leads to a “poverty trap.”

Much of Holling’s work has focused on the crucial role of resilience in both natural and human systems, and the Resilience Alliance has been the result:

We define resilience, formally, as the capacity of a system to absorb disturbance and reorganize while undergoing change so as to still retain essentially the same function, structure and feedbacks – and therefore the same identity.

Resilience arises from a redundancy that has the appearance of inefficiency and a lack of critical structural dependency on specialized hierarchy, neither of which conditions are likely to be met at the peak of the growth phase of an adaptive cycle. For these to be achieved from this point at least a partial, or localized, collapse to a simpler level of organization would have to occur. There can potentially be a fine line between a retreat from rigidity to this level of resilience and a ‘poverty trap’, where a collapse has proceeded so far and so fast that the system has been stripped of the wealth (biological or otherwise) that it would need to rebuild. Where adaptive cycles have become synchronized, so that the likelihood of deep collapse is increased, striking a balance of resilience would be far more difficult.

A resilient world would promote biological, landscape, social and economic diversity. Diversity is a major source of future options and of a system’s capacity to respond to change.

A resilient world would embrace and work with natural ecological cycles. A forest that is never allowed to burn loses its fire-resistant species and becomes very vulnerable to fire.

Walker, 2008

A resilient world consists of modular components. When over-connected, shocks are rapidly transmitted through the system – as a forest connected by logging roads can allow a wild fire to spread wider than it would otherwise.

A resilient world possesses tight feedbacks. Feedbacks allow us to detect thresholds before we cross them. Globalization is leading to delayed feedbacks that were once tighter. For example, people of the developed world receive weak feedback signals about the consequences of their consumption.

A resilient world promotes trust, well developed social networks and leadership. Individually, these attributes contribute to what is generally termed “social capital,” but they need to act in concert to effect adaptability – the capacity to respond to change and disturbance.

A resilient world places an emphasis on learning, experimentation, locally developed rules, and embracing change. When rigid connections and behaviors are broken, new opportunities open up and new resources are made available for growth.

A resilient world has institutions that include “redundancy” in their governance structures and a mix of common and private property with overlapping access rights. Redundancy in institutions increases the diversity of responses and the flexibility of a system. Because access and property rights lie at the heart of many resource-use tragedies, overlapping rights and a mix of common and private property rights can enhance the resilience of linked social-ecological systems.

A resilient world would consider all nature’s un-priced services – such as carbon storage, water filtration and so on – in development proposals and assessments. These services are often the ones that change in a regime shift – and are often only recognized and appreciated when they are lost.

This will be a very tall order in a panarchic future.

Prechter, Elliottwaves and Socionomics

Bob Prechter has also spent decades studying the structure of nested cycles, but in his case in financial markets, carrying on the work of RN Elliott, who established the field in the 1930s. Elliott painstakingly documented motive (impulse) and corrective patterns which unfold at all degrees of trend simultaneously – from small moves completing in minutes to larger cycles playing out over months, years, decades and longer. Elliott noted that motive waves in the direction of the one larger trend occur in fives, while corrective waves counter to the one larger trend form threes or multiples thereof.

Prechter explains that this is the minimum requirement for an adaptive cycle capable of both fluctuation and progress, and therefore the most efficient form. Each move itself is composed of the same patterns, while each also forms a component part of larger structures. (Motive waves are labeled with numbers, while corrective waves are labeled with letters.)

As opposed to self-identical fractals, whose parts are precisely the same as the whole, and indefinite fractals, which are self-similar only in that they are similarly irregular at all scales, a robust fractal is one of intermediate specificity. Though variable, its component forms, within a certain defined latitude, are replicas of the larger forms. Prechter, 1999, p17

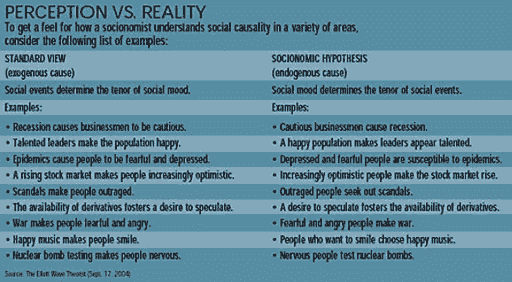

Bob Prechter’s socionomics model combines Elliott’s observed fractal patterns with an understanding of human herding behaviour, comprising a comprehensive challenge to prevailing notions such as the Efficient Market Hypothesis by reversing causation and recognizing the role of emotional/irrational behaviour as the prime market driver. While the real economy demonstrates negative feedback loops, finance is thoroughly grounded in positive feedback.

Socionomics provides a model of collective mood swings which permits collective human behaviour prediction in finance, the real economy and beyond. Consensus takes time to build, so that the more extreme the sentiment, the closer one is to a trend change. Collectively optimistic people engage in one range of behaviours over different timescales – typically buy stocks, borrow funds to build businesses, employ others in the expectation of profit, vote for incumbents whom they credit with stability, engage in cheerful expressions of popular culture and behave in an increasingly inclusive manner in recognition of common humanity.

Collectively pessimistic people become increasingly risk averse and suspicious of others, in whom they look for differences rather than similarities. Both optimistic and pessimistic behaviours, particularly in their extreme forms, can create self-fulfilling prophecies for varying periods of time, until perception substantially overshoots reality and the trends it creates can no longer be sustained. The manic trend of recent years has led to an unsustainable debt burden of unprecedented scope and complexity. It also led to an unprecedented degree of global economic and financial integration dependent on hierarchical specialization, comparative advantage and just-in-time delivery that are clear examples of rigidity creating a brittle system.

Like Holling’s panarchy, Prechter’s nested socionomic cycles either reinforce or counter each other depending on the direction of cycles larger and smaller than the one under consideration. Where cycles at several degrees of trend are moving in the same direction, the move will be extreme – either a mania to the upside or a crash to the downside. The largest mania ever known topped in the year 2000, and we have been in bear market territory since then (more obviously in real terms).

We are now approaching a synchronized move in the opposite direction as the rally of recent months peters out in the face of the larger downtrend. The consequences of this will be considerable, but we are still quite near the beginning of the large-scale and complex downward pattern the model predicts will unfold over the next several decades. We can expect many deleveraging cascades and many intervening rallies, some larger than we have seen so far.

It is inevitable that the complex web of debt instruments and inter-dependencies that humanity invented to prolong its growth phase (to use Holling’s terminology) by stealing from the future will be a prime focus for a sharp reversal, as we have already reached the point where additional debt provides less than no benefit. Socionomics tells us that the trust and complacency as to systemic risk that allowed this debt structure to develop will be primary casualties of a synchronized move to the downside, being both cause and effect in a powerful positive feedback loop.

Tainter, Complexity and Peer Polities

Joseph Tainter’s work complements that of Holling and Prechter, providing a framework of diminishing marginal returns to complexity which encompasses ecosystems, individual societies and competitive peer polities. As complexity increases, it eventually becomes a liability, as we can see with Holling’s description of rigidity reducing the resilience of ecosystems and Prechter’s many writings on the debt complexity of manias and the systemic risk it engenders.

As with diminishing marginal productivity of debt, past a certain point further investments in complex solutions to increasingly complex problems has a negative return. Tainter explains, however, that where there is not a single political structure, but instead competitive peer polities, these entities become trapped in a competitive spiral where investment in organizational complexity must be maintained regardless of cost, as the alternative is domination by another member of the cluster at the same level of complexity, rather than collapse to a simpler system. The counter-productive actions of states are legitimized to the citizenry by the fact that each member of the cluster is engaging in the same behaviour. Collapse, which requires a power vacuum, is not possible unless the whole cluster collapses at once at the point of economic exhaustion.

Peer polity systems tend to evolve toward greater complexity in lockstep fashion as, driven by competition, each partner imitates new organizational, technological, and military features developed by its competitors. The marginal return on such developments declines, as each new military breakthrough is met by some counter-measure, and so brings no increased advantage or security on a lasting basis.. A society trapped in a competitive peer polity system must invest more and more for no increased return, and is thereby economically weakened. And yet the option of withdrawal or collapse does not exist…..Peer polity competition drives increased complexity and resource consumption regardless of cost, human or ecological.

Tainter, 1988, p214

Tainter observes that the peer polity nature of the modern world creates a more apt comparison with the rapid collapse of the ancient Maya than with the slow decline of Rome. To use Holling’s terminology, we have seen a panarchy of nested cycles synchronize, with the effect of artificially extending the growth phase for all simultaneously. The evidence for this is abundantly available in terms of the many limits to growth we are approaching or have reached, most notably the high EROEI energy required to maintain complexity. The significant risk is therefore of deep collapse over a relatively short period of time (although this would still likely be decades at least).

Collapse, if and when it comes again, will this time be global. No longer can any individual nation collapse. World civilization will disintegrate as a whole. Competitors who evolve as peers collapse in like manner.

Tainter, 1988, p214

References

- LH Gunderson and CS Holling (2001). Panarchy: Understanding Transformations in Human and Natural Systems.

- RR Prechter (1999). The Wave Principle of Human Social Behaviour and the New Science of Socionomics.

- RR Prechter (2002). Conquer the Crash.

- RR Prechter (2003). Pioneering Studies in Socionomics.

- JA Tainter (1988). The Collapse of Complex Societies.